- Bay Area Times

- Posts

- Fed holds rates as U.S. GDP rebounds 3%, signals slowing activity ahead

Fed holds rates as U.S. GDP rebounds 3%, signals slowing activity ahead

Top stories today:

- Fed holds rates, signals slowing activity ahead

- U.S. GDP +3.0% in Q2, with +1.4% in consumer spending

- Microsoft Cloud drives +18% YoY in revenue in Q4 FY25

- Meta Q2 revenue +22% YoY, net income +36% on rising AI demand

- Trump slaps 15% tariffs on South Korea, 25% on India over Russia ties

0. Data and calendar

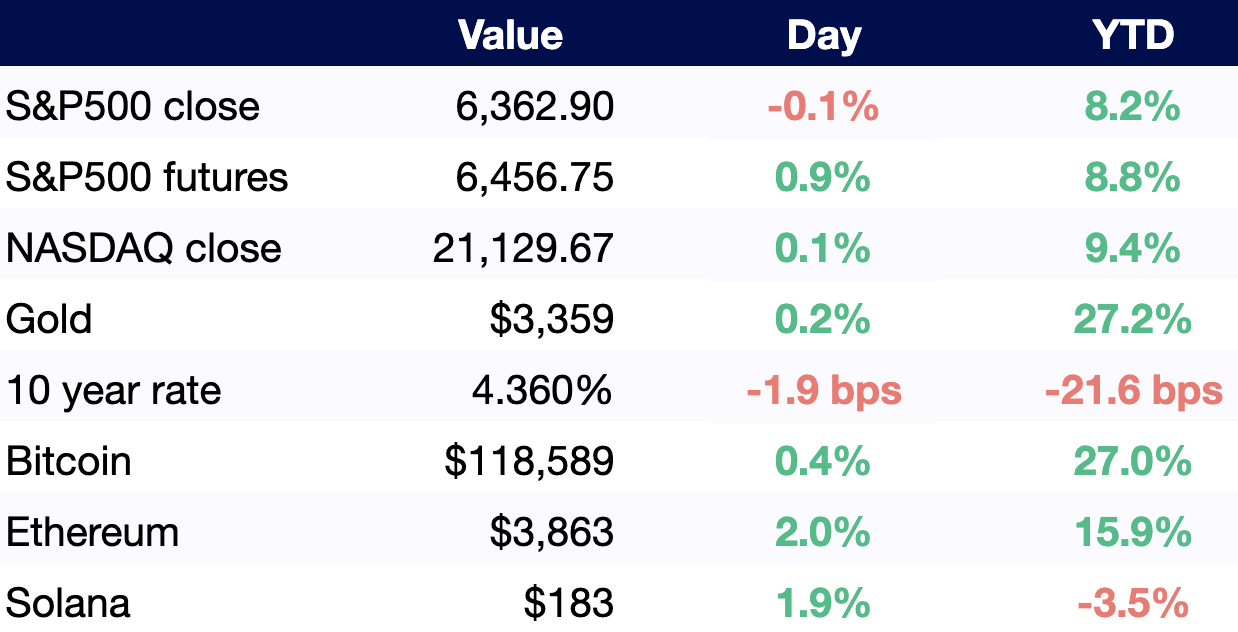

All values as of 6 AM ET / 3 AM PT, other than S&P500 and NASDAQ close (4 PM ET / 1 PM PT).

All times are ET.

Listen to our AI-generated podcast summarizing today’s newsletter (beware of hallucinations):

1. Fed holds rates as U.S. GDP rebounds 3%, signals slowing activity ahead

The 4.25%-4.50% range held by the Federal Reserve for a 5th straight meeting Wed.

Committed to making sure any one-time increases in prices didn’t lead to more-persistent inflation, Fed chair Jerome Powell said.

“There are many, many uncertainties left to resolve,” Powell told reporters.

Fed Gov. Waller and Bowman dissented in favor of the rate cut — 1st time in over 30 years 2 officials have dissented.

1st meeting since 2020 in which more than 1 Fed official voted against Powell.

2. U.S. GDP +3.0% in Q2, with +1.4% in consumer spending

Results were better than the 2.5% expected for GDP.

Personal spending below 2% in both Q1 and Q2 could be an effect of tariff uncertainty.

Finding skilled finance professionals shouldn’t be hard. With Finance Hires, you get vetted accountants, controllers, and bookkeepers ready to support your business.

Same time zone, 50% salary savings.

Expertise in QuickBooks, Xero, US GAAP.

Experience from firms like PwC, Deloitte, and JP Morgan.

Skip long hiring cycles. Get top nearshore finance talent to keep your books accurate, compliant, and on time.

*Sponsored.

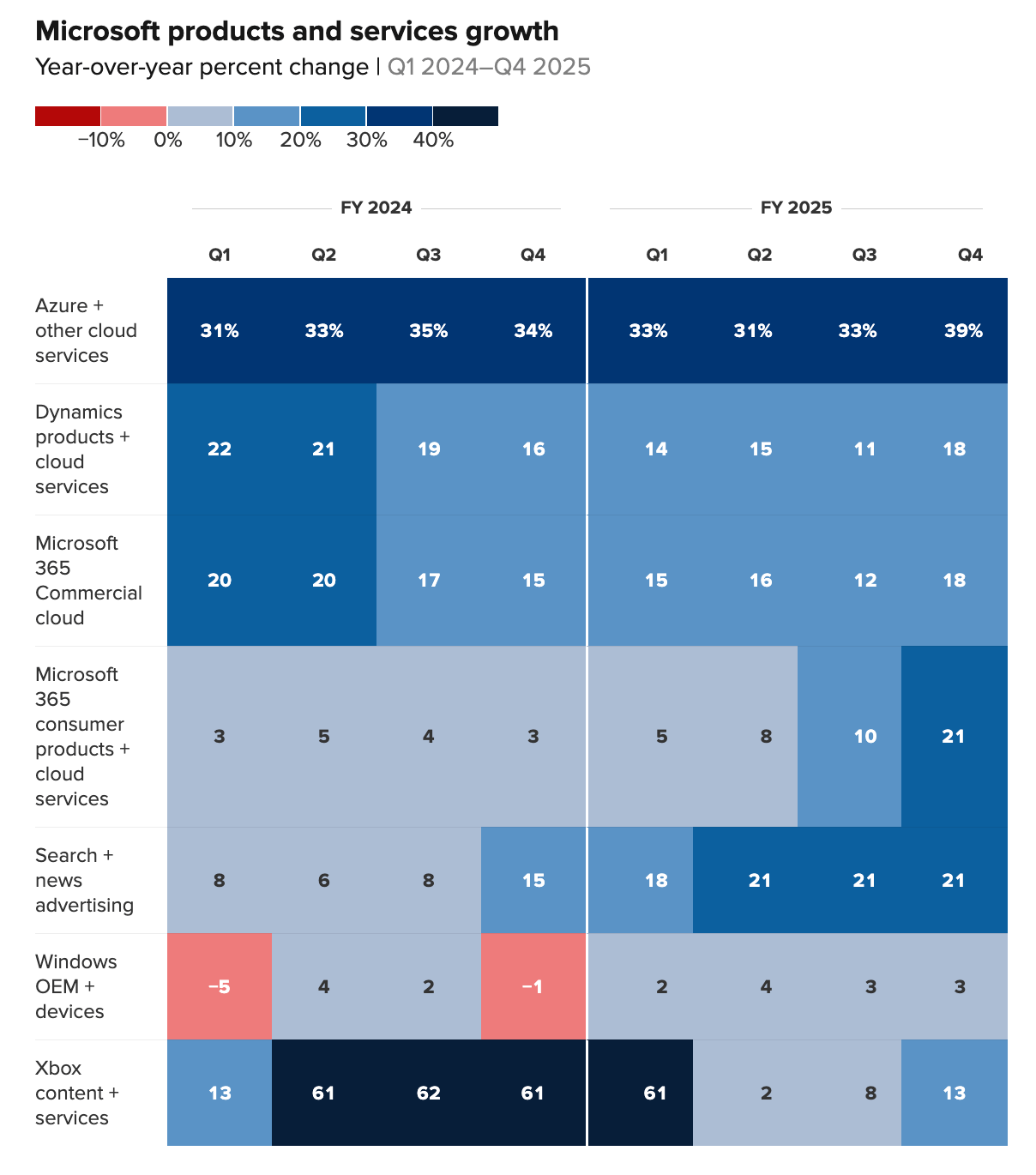

3. Microsoft Cloud drives +18% YoY in revenue in Q4 FY25, operating income +23% to $34.3B

+24% YoY in net income to $27.2B.

Microsoft’s Azure and other cloud services revenue +34% YoY to $75B in the fiscal 2025

Microsoft has planned a record $30B in quarterly capital spending to meet surging AI demand

$24.2B in Q4 capex, with 50% for long-lived assets to support 15+ years of monetization and the remainder on AI infra., CFO Amy Hood said.

Microsoft is set to hit $4T valuation, second after NVIDIA, after its earnings topped Wall Street estimates

4. Meta Q2 revenue +22% YoY to $47.5B, net income +36% on rising AI demand

“[G]reater efficiency and gains across our ad system” through Meta’s AI tech, CEO Mark Zuckerberg said.

+21% in advertising revenue to $46.6B.

The AI spending blitz will continue into 2026, Zuckerberg said.

Outlined a “personal superintelligence” vision in a letter posted on Wed.

AI increased the time spent on Facebook and Instagram in Q2, Zuckerberg said.

Reality Labs (Meta’s VR division) posted a $4.5B loss on $370M in revenue

Meta raised its yearly capex forecast to $66B-$72B, lifting the low end from $64B

CAPEX was +101% YoY to $17.0B in Q2:

Meta reported +6% YoY to 3.48B in “daily active people”

Average revenue per person was +15% to $13.65

5. Trump slaps 15% tariffs on South Korea, 25% on India over Russia ties ahead of Fri. deadline

A $350B South Korean fund for U.S. investments, including energy and shipbuilding, is said to be in plans.

90% of profits from U.S. investments in South Korea will return to the U.S., Commerce Secy. Howard Lutnick said.

Trump threatened an undefined penalty on India for its purchases of Russian energy.

Most countries are still without a trade deal with the U.S.

6. OpenAI’s ARR 2x’d to $12B since Jan.

Likely to cross the $12.7B revenue projection for 2025, up from ~$4B. in 2024.

$8B projected 2025 cash burn, up $1B from earlier estimate, vs. $3B for Anthropic.

ChatGPT now has 700M weekly active users

7. Ramp valued at $22.5B in $500M raise for AI agent push

Iconiq led the Series E-2 round, with participation from existing investors, including Founders Fund and D1 Capital Partners.

8. Google DeepMind unveils AlphaEarth to unify Earth data, generate maps on demand

Cuts error rates by ~24% and uses 16x less storage than other AI systems, helping to reduce the cost of planetary-scale environmental analysis.

AlphaEarth uses “embedding fields” to map Earth’s surface in 10-meter squares

Satellite Embedding dataset is available in Google Earth Engine for researchers and developers.

Available under Google Earth AI, Google’s collection of geospatial models and datasets.

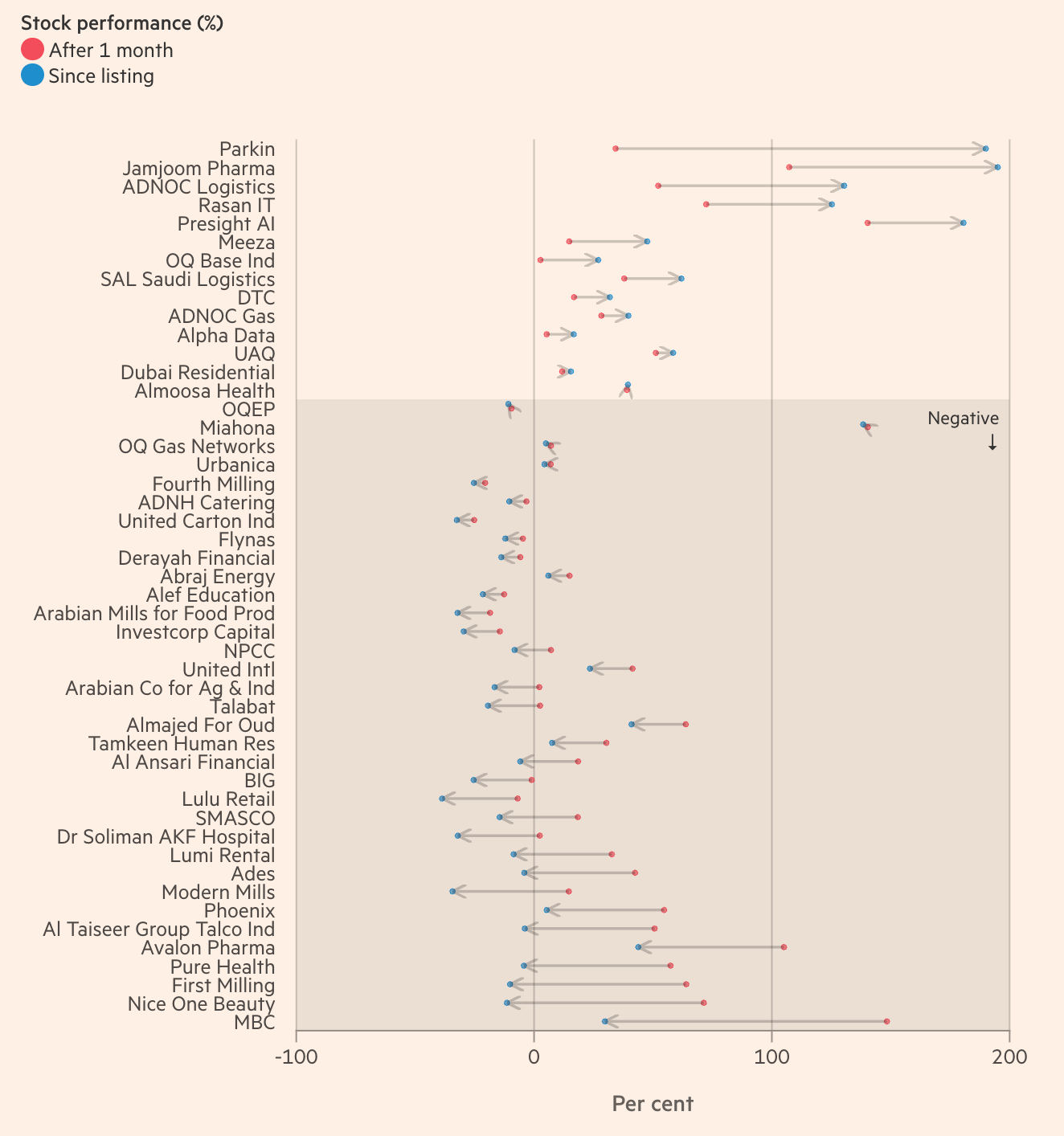

9. Saudi market slump raises doubts on diversification drive

Newly floated Saudi stocks have gained only 4% on average in their 1st month of trading, vs. 27% in 2024, per Dealogic:

Packaging company United Carton Industries and budget carrier Flynas are among the losers

10. Interesting videos, posts, and memes

11. Other headlines

AI

Athyna: Elite Product Managers, AI-Matched.*

*Sponsored.

Tech

Figma raises $1.2B in hotly awaited IPO, prices above range.

Arm to explore designing its own chips: CEO.

Samsung profit -50% as chip business plunges 94%, misses estimates.

Qualcomm Q3 FY25 revenue hits $10.37B, net income $2.66B.

eBay Q2 profit +64% to $368M, lifts guidance as sales top estimates.

Tech & Law

NVIDIA’s H20 chips flagged by China over potential security risks.

Biotech

Timeless Biotech CEO says ML predicts ovarian aging systemically.

Neu Health launches phone-based Parkinson’s, dementia platform.

Apple, Google, OpenAI to work with Trump admin on improving health data.

Business

BMW sticks with guidance despite profit drop, Trump’s tariffs.

De minimis exception ends as Trump scraps import exemption.

Crypto

Trump crypto group urges clearer rules to boost digital finance.

Robinhood Q2 revenue +45% YoY to $989M, net income +105% to $386M.

U.S. politics

Treasury secy. calls Trump accounts “a backdoor” to privatize Social Security.

Kamala Harris won’t run for California governor in 2026.

World

Disclaimer: The Bay Area Times is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. You should do your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Bay Area Times team.

Please read our Terms of Service and our Privacy Policy before using Our Service.