- Bay Area Times

- Posts

- OpenAI said to upgrade audio AI ahead of voice-first personal device

OpenAI said to upgrade audio AI ahead of voice-first personal device

Top stories today:

- OpenAI said to upgrade audio AI ahead of voice-first personal device

- Neuralink plans “high-volume” brain implant production by 2026

- Tesla Q4 deliveries expected -11% YoY to ~440.9K

- SpaceX, OpenAI, Anthropic IPOs could eclipse 2025 IPO proceeds

- Moonshot AI raises $500M at $4.3B valuation led by IDG

- Pickle 1 AI glasses debut with memory that “adapts” to users over time

0. Calendar

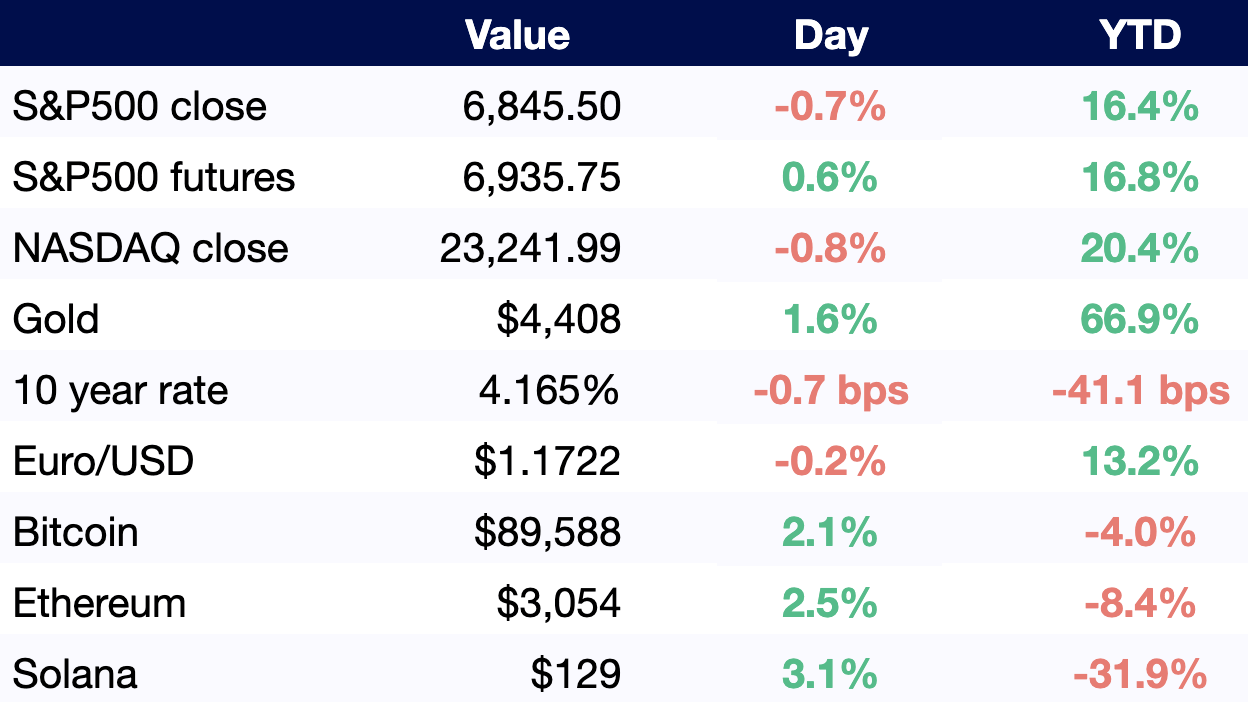

All values as of 6 AM ET / 3 AM PT, other than S&P500 and NASDAQ close (4 PM ET / 1 PM PT).

No major events today.

Listen to our AI-generated podcast summarizing today’s newsletter (beware of hallucinations):

1. OpenAI said to upgrade audio AI ahead of voice-first personal device

Representational image generated using ChatGPT.

OpenAI has reportedly unified engineering, product, and research teams to improve audio models.

A new audio architecture aims for more natural, emotive responses.

Q1 2026: the upgraded audio model is expected to debut.

OpenAI’s device is designed as a proactive, voice-first AI companion.

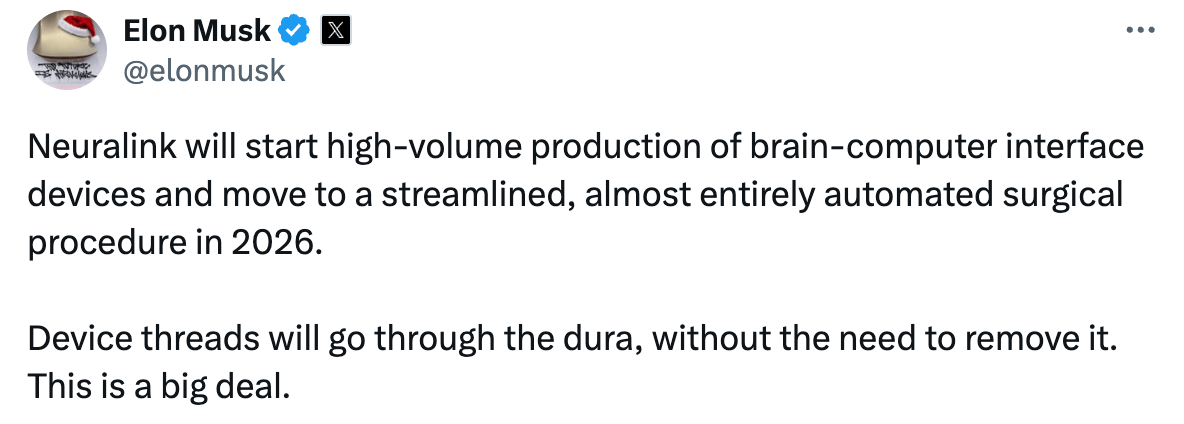

2. Neuralink plans “high-volume” brain implant production by 2026, Elon says

Neuralink aims to shift to fully automated surgical procedures in 2026, Elon Musk said.

2024: human trials for Neuralink’s brain implant began.

Sep.: 12 people worldwide with severe paralysis have received the implant, the company said.

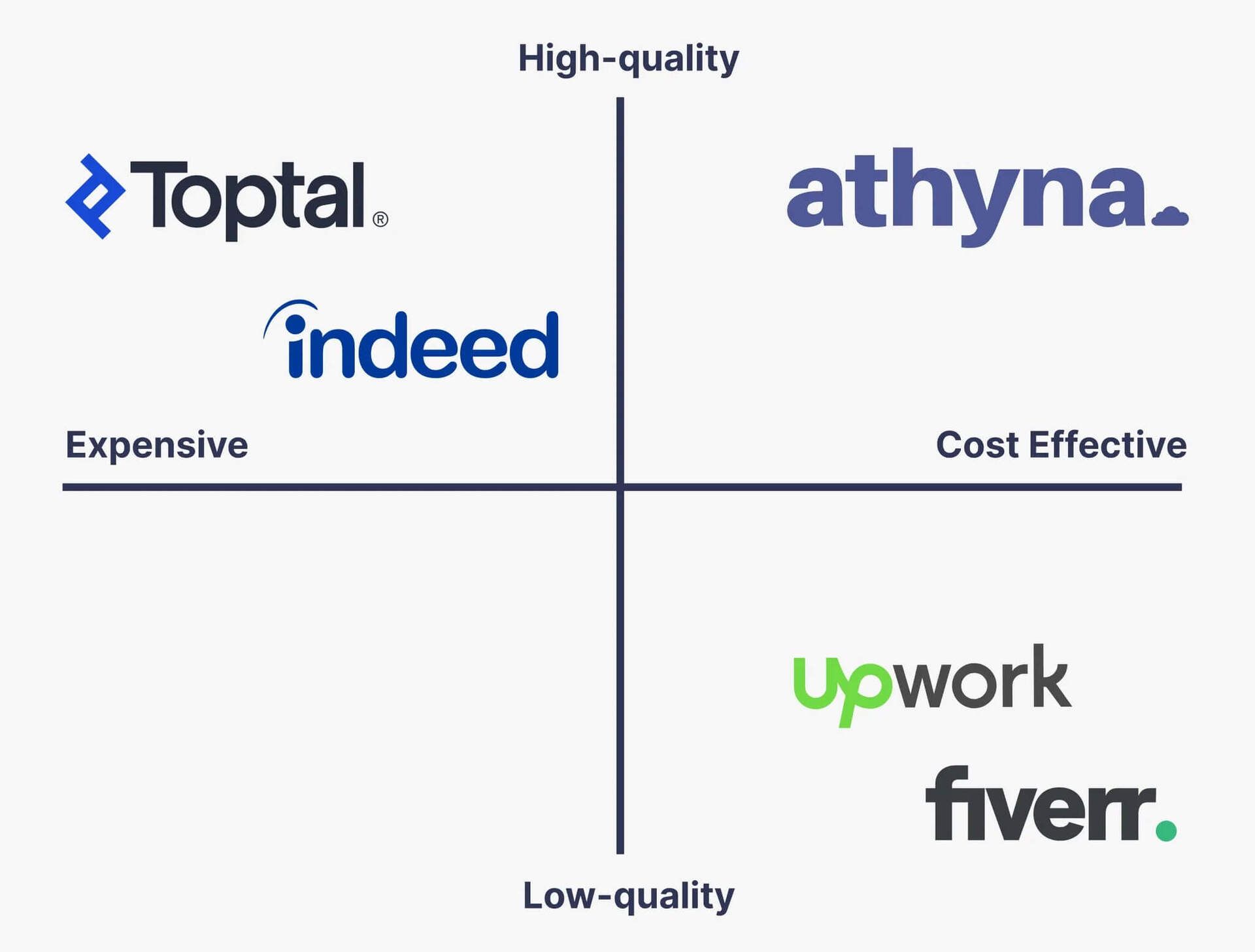

There’s a better way. Athyna helps you build high-performing teams—fast, affordable, and without the hiring headaches.

Here’s how:

🤖 AI-powered matching connects you with talent tailored to your needs.

⚡ 4 days from brief to interviews.

💸 Save up to $80K per hire with top LATAM engineers.

Speed, precision, and serious savings—no compromises.

👉 Ready to change the way you hire?

*Disclaimer: We have equity in Athyna.

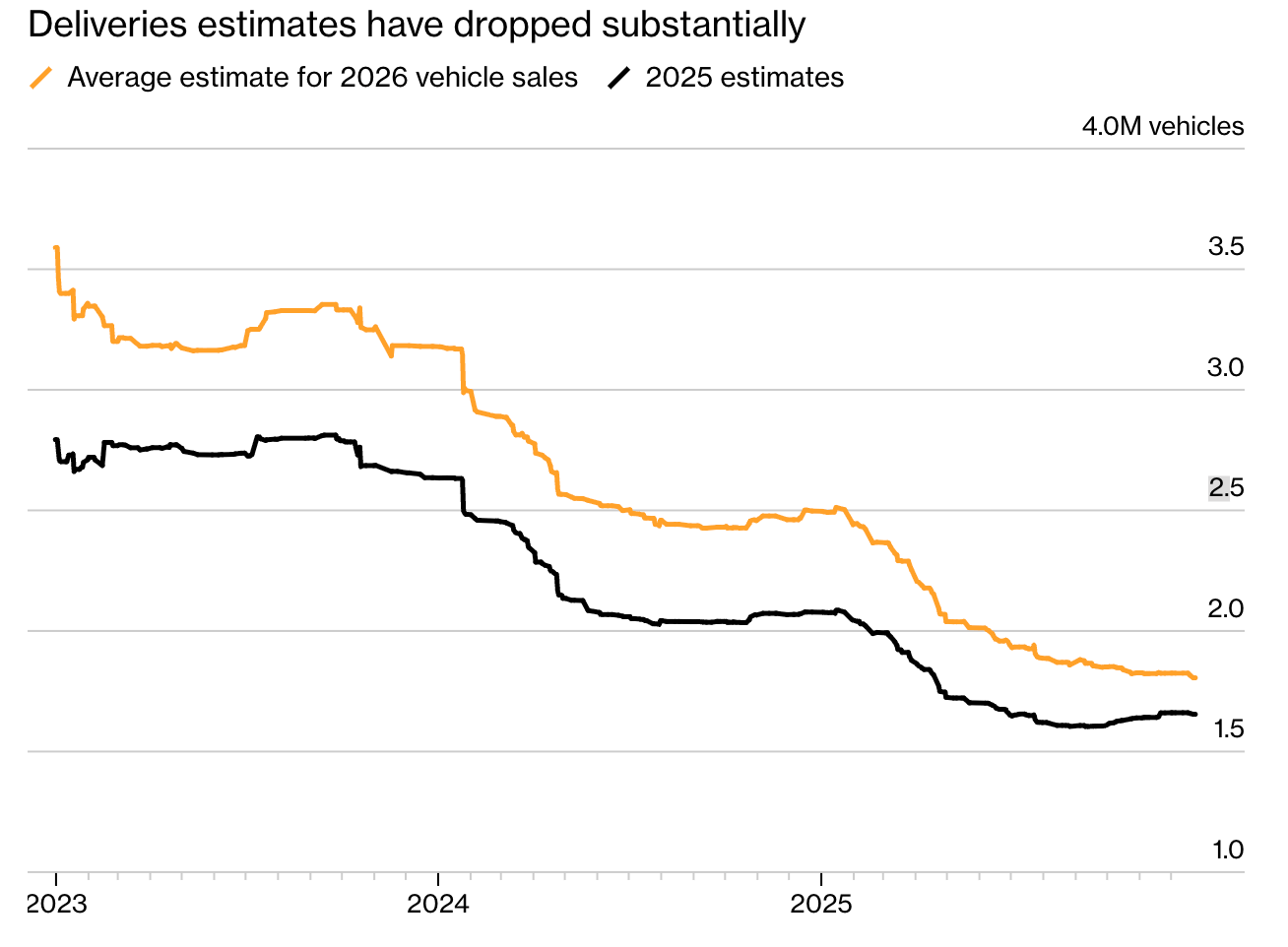

4. Tesla Q4 deliveries expected -11% YoY to ~440.9K as sales outlook weakens

Analysts’ 2026 delivery forecasts have slid sharply, from 3M+ vehicles two years ago to ~1.8M now: