- Bay Area Times

- Posts

- Oracle Q2 FY26 revenue +14% YoY to $16.1B, misses $16.2B estimate

Oracle Q2 FY26 revenue +14% YoY to $16.1B, misses $16.2B estimate

Top stories today:

- Oracle Q2 FY26 revenue +14% YoY to $16.1B, misses $16.2B estimate

- Fed cuts rates for 3rd straight meeting, signals possible pause

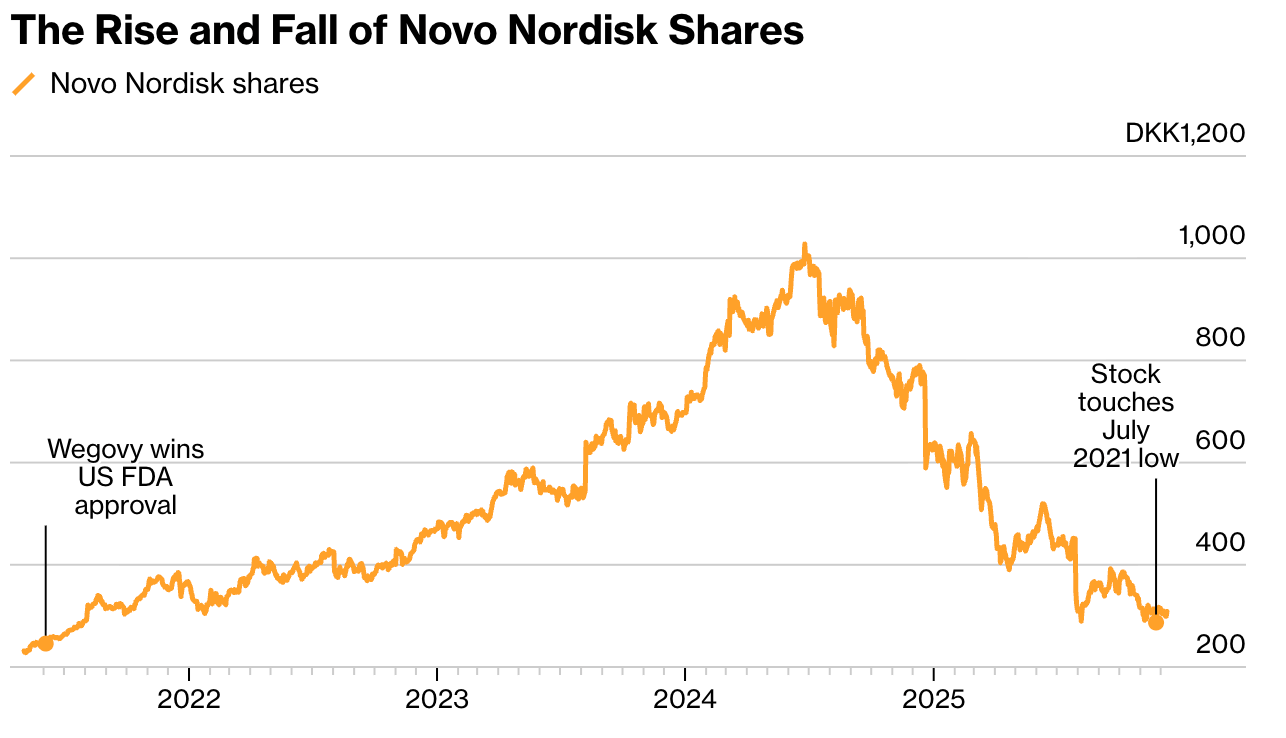

- Novo Nordisk heads for worst-ever year after 50% stock plunge

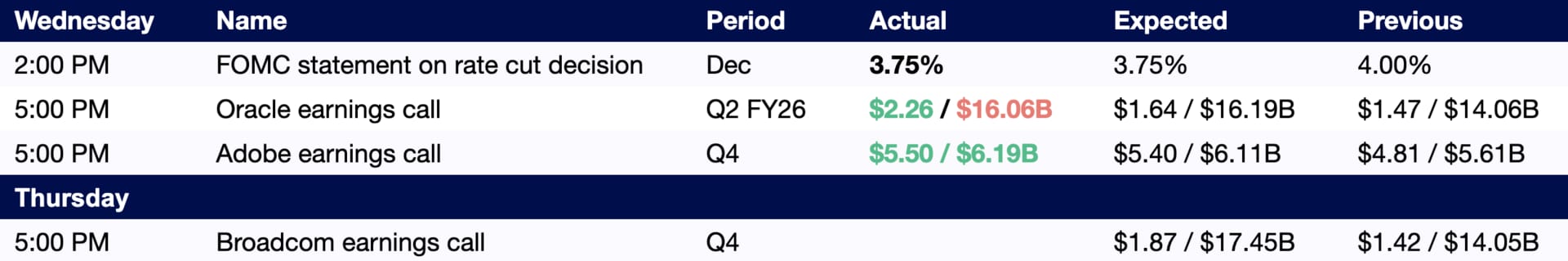

- Adobe Q4 revenue +10% YoY to $6.2B, guides $25.9B–$26.1B FY sales

- Nick Clegg joins Hiro Capital as GP, Yann LeCun named adviser

- ChatGPT tops 2025 U.S. iOS downloads, rising to #1 from #4 2024

0. Data and calendar

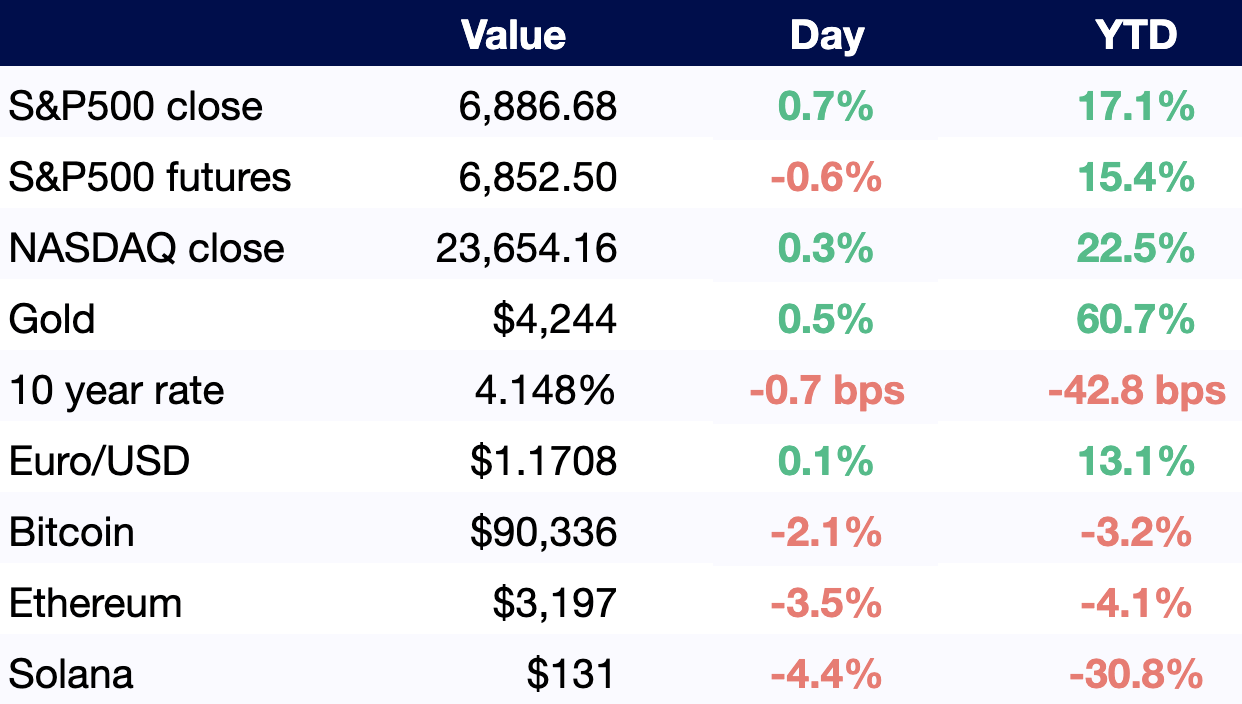

All values as of 6 AM ET / 3 AM PT, other than S&P500 and NASDAQ close (4 PM ET / 1 PM PT).

All times are ET.

Listen to our AI-generated podcast summarizing today’s newsletter (beware of hallucinations):

1. Oracle Q2 FY26 revenue +14% YoY to $16.1B, misses $16.2B estimate

+34% YoY in Q2 cloud revenue to $8B.

+68% in cloud infrastructure revenue to $4.1B.

-3% in software revenue to $5.9B.

$50B in fully-year capital expenditure projected, up from $35B as of Sep.

$21.2B was the sum for fiscal 2025.

Shares remain -32% the Sep. record, though still +34% YTD.

-23% in Nov. alone.

NVIDIA and AMD -1%, while CoreWeave -3% after Oracle’s weaker-than-expected revenue despite booming AI demand.

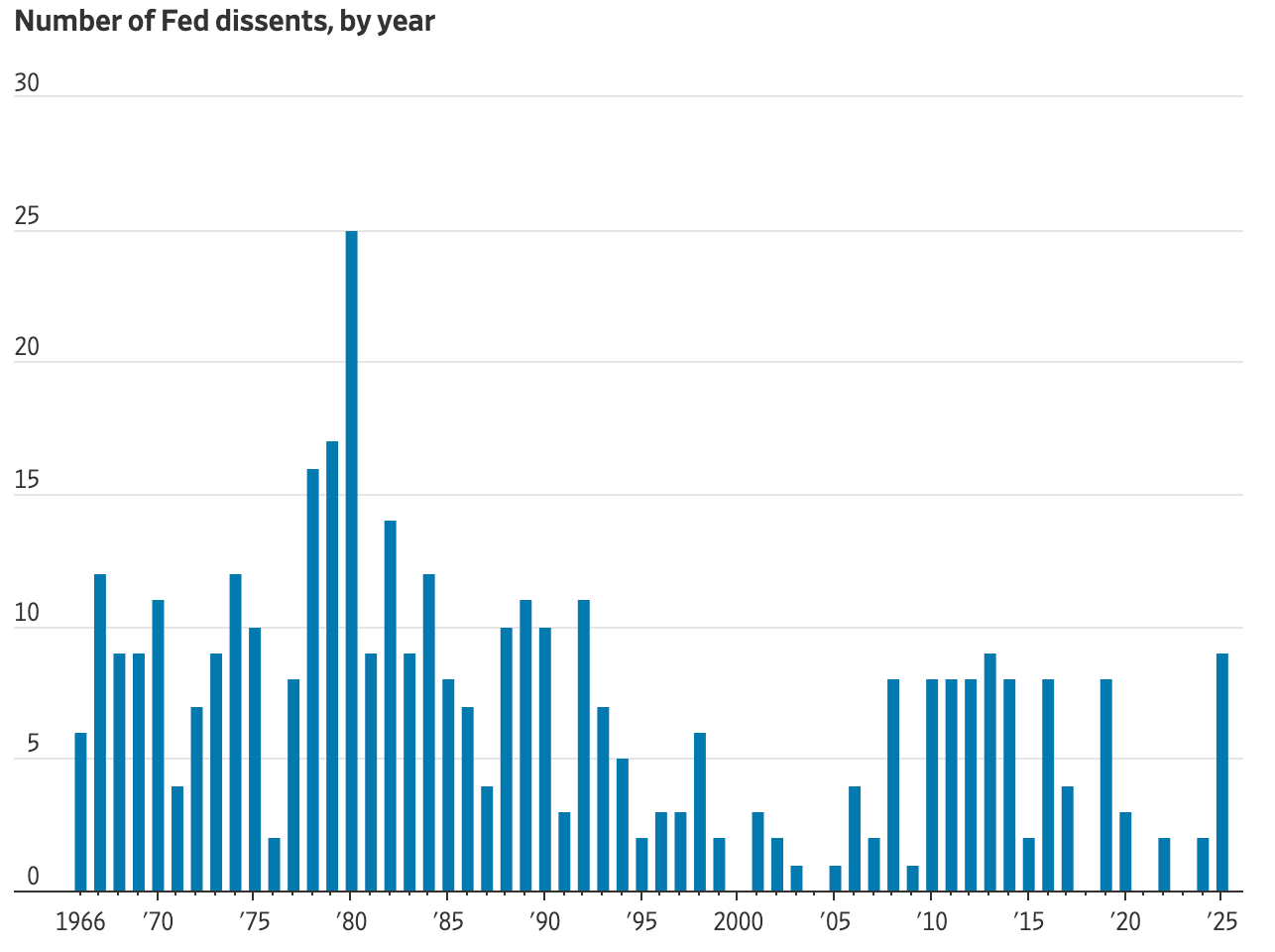

2. Fed cuts rates for 3rd straight meeting, signals possible pause amid internal divisions

The FOMC voted 9-3 on Wed. to cut the federal funds rate by 25 bps to between 3.5%-3.75%:

“We're well-positioned to wait and see how the economy evolves from here,” Fed Chair Jerome Powell said after the FOMC meeting.

Still, Powell defended the decision to cut now rather than waiting until the Fed’s next meeting in late Jan.

This marks the 1st time in 6 years that three officials dissented

2 officials argued the cut wasn’t warranted, and 1 favored a larger half-point move.

With Athyna, you get Forward Deployed Engineers who don’t just build software—

they embed into your team, understand your business, and deploy solutions that work right now.

Here’s what you get:

Modern tech stack expertise—engineers experienced in Python, TypeScript, React, Node.js, AWS, Kubernetes, Terraform, and more.

AI-powered matching that identifies engineers aligned to your stack, product, and use case—no guesswork, no mismatches.

4-day turnaround—from brief to interviews, so you start shipping fast instead of waiting for hiring cycles.

Save up to $80k per year, per hire with top-tier global talent ready to deploy.

*Disclaimer: We have equity in Athyna.