- Bay Area Times

- Posts

- SoftBank completes $22.5B OpenAI investment, finalizing $41B commitment

SoftBank completes $22.5B OpenAI investment, finalizing $41B commitment

Top stories today:

- SoftBank completes $22.5B OpenAI investment

- NVIDIA said to be in advanced talks to acquire AI21 for $2B–$3B

- Retro Biosciences reaches clinic with first autophagy drug trial

- Tesla estimates -15% YoY in Q4 car deliveries to ~423K

- Warner Bros. said to plan rejecting Paramount offer next week

- Trump Mobile delays “T1” gold smartphone launch, citing shutdown

0. Calendar

All values as of 6 AM ET / 3 AM PT, other than S&P500 and NASDAQ close (4 PM ET / 1 PM PT).

No major events today.

Listen to our AI-generated podcast summarizing today’s newsletter (beware of hallucinations):

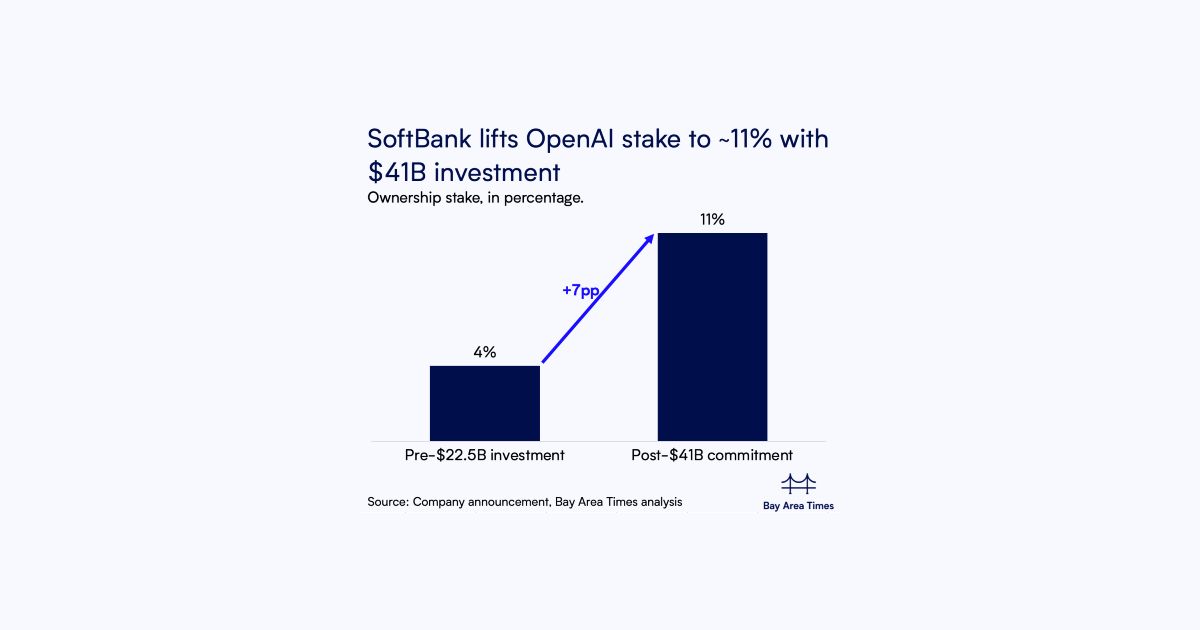

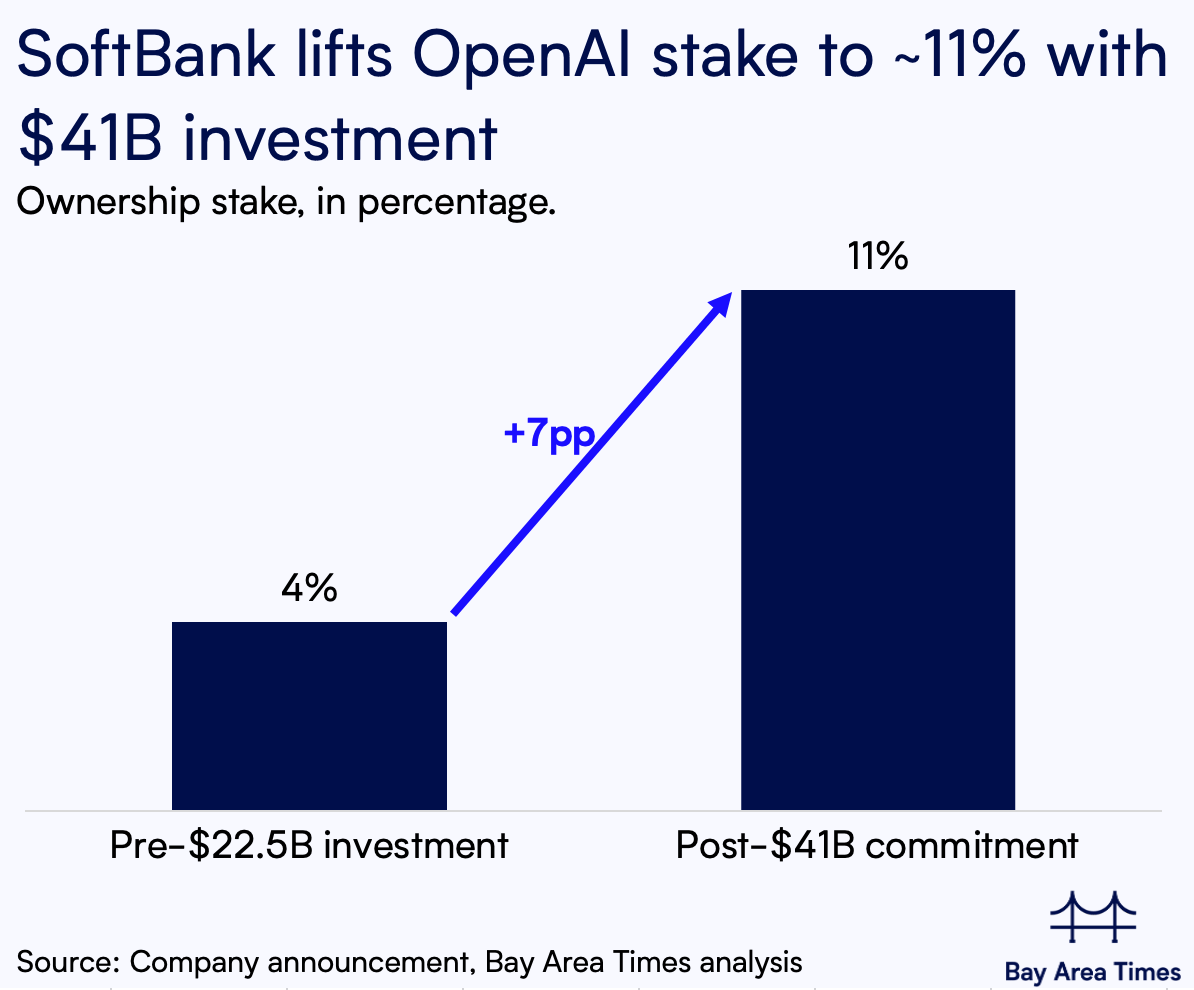

1. SoftBank completes $22.5B OpenAI investment, finalizing $41B commitment

SoftBank previously invested $7.5B in OpenAI.

Late Mar.: SoftBank committed up to $41B, including an $11B syndicated co-investment from other backers.

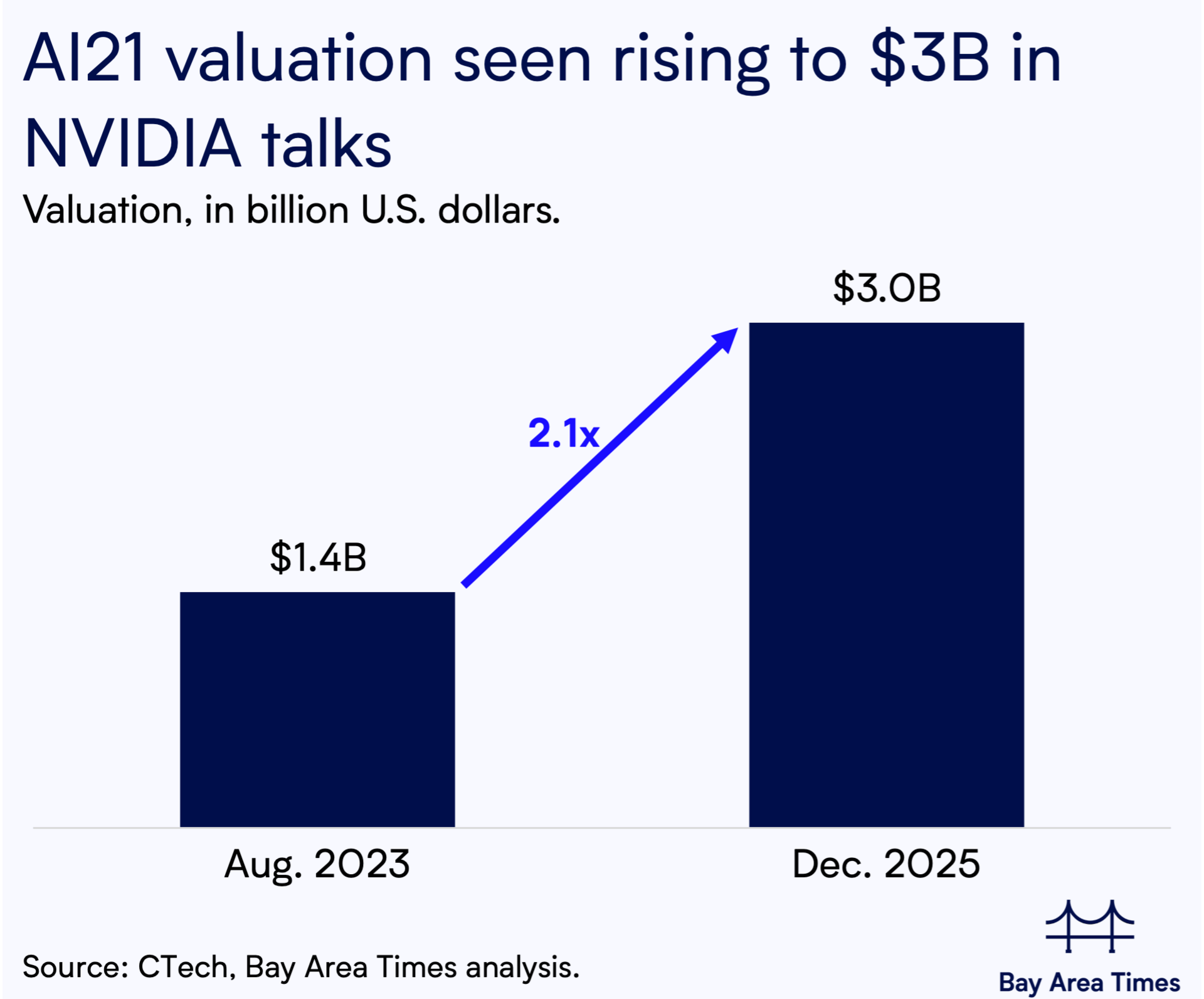

2. NVIDIA said to be in advanced talks to acquire AI21 for $2B–$3B

Google had also previously explored acquiring AI21, sources said.

NVIDIA’s primary interest appears to be AI21’s workforce of~200 employees.

The deal would resemble an acquihire, focused more on talent than technology.

It would mark NVIDIA’s 4th significant acquisition in Israel and its 2nd-largest after the $7B Mellanox deal.

With Athyna, you get Forward Deployed Engineers who don’t just build software—

they embed into your team, understand your business, and deploy solutions that work right now.

Here’s what you get:

Modern tech stack expertise—engineers experienced in Python, TypeScript, React, Node.js, AWS, Kubernetes, Terraform, and more.

AI-powered matching that identifies engineers aligned to your stack, product, and use case—no guesswork, no mismatches.

4-day turnaround—from brief to interviews, so you start shipping fast instead of waiting for hiring cycles.

Save up to $80k per year, per hire with top-tier global talent ready to deploy.

*Disclaimer: We have equity in Athyna.

4. Retro Biosciences reaches clinic with first autophagy drug trial

RTR242 has entered a Phase 1 trial to restore lysosomal function:

The candidate aims to help neurons clear toxic proteins and restore more youthful cellular function.

The Phase 1 study is a randomized, double-blind, placebo-controlled trial in healthy volunteers.

The trial is being conducted in Adelaide, Australia.

Retro is also exploring cell therapies, including an approach to rejuvenate the brain’s immune cells.

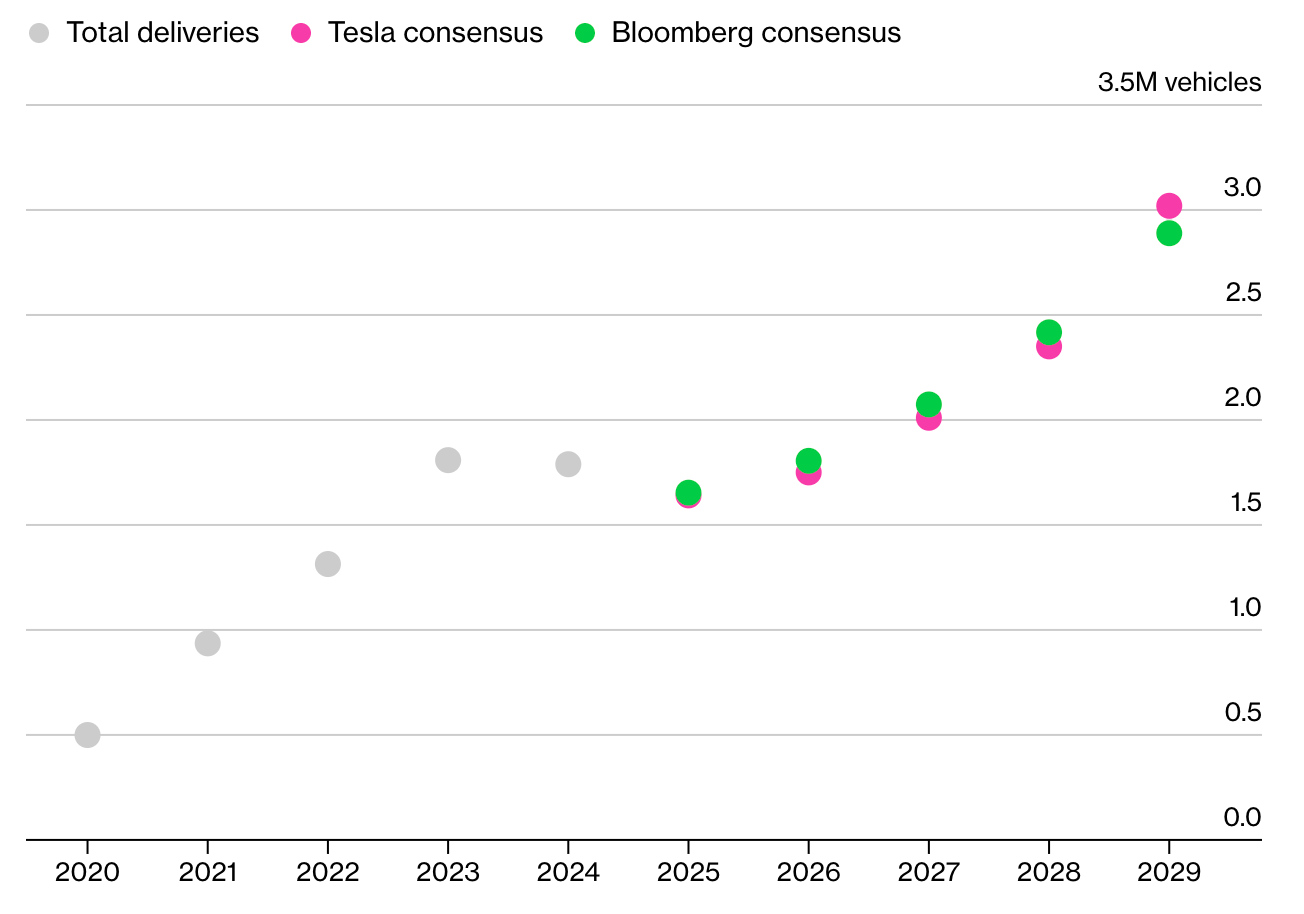

5. Tesla estimates -15% YoY in Q4 car deliveries to ~423K

Q4 deliveries were estimated at 440,907 vehicles by Bloomberg.

Tesla has expected -8% YoY annual deliveries at ~1.6M.

Tesla’s delivery outlook for the next three years is also below Bloomberg consensus

Tesla stock is still +14% YTD through Mon. close, despite the sales slowdown.

6. Warner Bros. said to plan rejecting Paramount offer next week

Warner Bros. shares were little changed on Tue. following the report:

Paramount has yet to raise its earlier bid, a key concern for the Warner Bros. board.

Dec. 8: Paramount offered $30/share in cash, three days after Warner Bros. accepted Netflix’s deal.

Paramount later amended the offer twice, most recently adding Larry Ellison’s $40.4B personal guarantee.

Next week: the Warner Bros. board is set to meet to decide.

7. Trump Mobile delays “T1” gold smartphone launch, citing government shutdown

Trump Mobile’s customer service team confirmed the delay in deliveries.

Jun.: the “U.S.-made” smartphone was unveiled at $499 to take on Apple and Samsung flagships.

Aug.: The device was initially slated to debut.

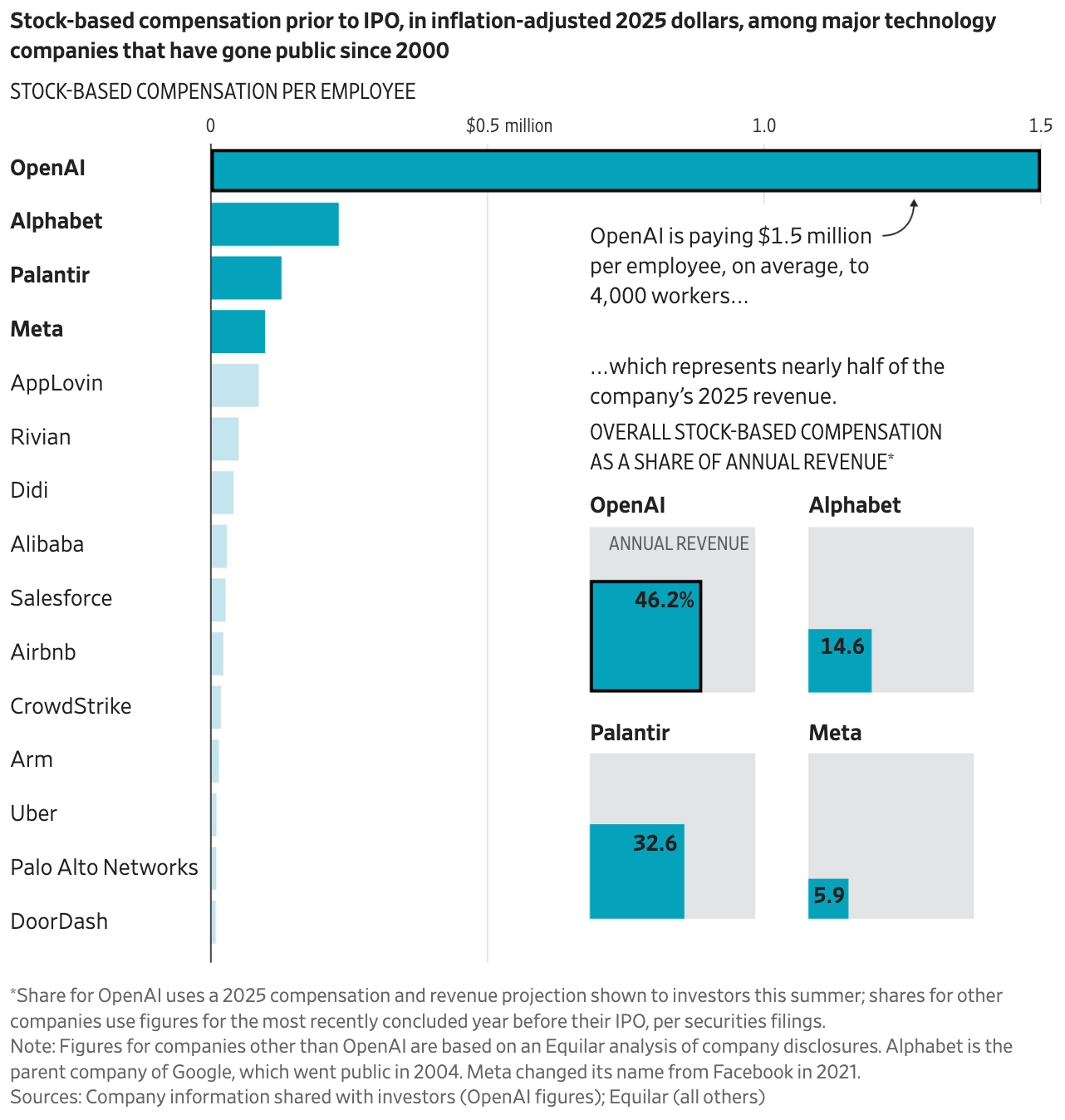

8. OpenAI stock pay averages $1.5M per employee, far outpacing peers

9. Chinese AI firms fuel Hong Kong IPO rush as 25 companies list in Dec., most since 2019

10. Chinese carmakers take 12.8% of Europe EV sales in Nov., hybrids top 13% despite EU tariffs

11. Interesting videos, posts, and memes

12. Other headlines

AI

ByteDance plans ~$14B on NVIDIA AI chips in 2026, +18% YoY: sources.

Manus’ China break seals Meta’s $2.5B deal, $500M retention pool: report.

xAI adds third site, nears 2GW training compute.

GroqCloud bids to top $1B after NVIDIA licensing deal: report.

Z.ai seeks $560M Hong Kong IPO at $6.6B valuation.

Athyna: Save $80,000 per year on every engineering hire.*

*Sponsored.

Tech

Tech & Law

Biotech

CardioKG uses AI heart maps to speed drug discovery.

TruDiagnostic tops consumer at-home aging test list.

Business

Crypto

Cypherpunk buys $28M of zcash, now owns 1.7% of supply.

Grayscale files for 1st U.S. Bittensor ETP.

Bitwise files with SEC for 11 single‑token “strategy” crypto ETFs.

U.S. politics

U.S. Coast Guard chases tanker as crew paints Russian flag.

Medicaid data can be shared with ICE under Trump admin, judge rules.

World

Disclaimer: The Bay Area Times is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. You should do your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Bay Area Times team.

Please read our Terms of Service and our Privacy Policy before using Our Service.